Navigate Savings: Revealing the current COD Oil Prices for Budget-Conscious Consumers

Wiki Article

Examining the Elements Affecting Oil Price and Its Impacts on Gas Oil

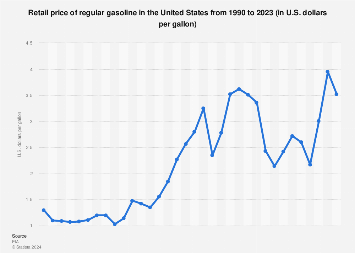

The rate of oil is an important aspect in the worldwide economic climate, with significant effects for different markets and customers. Understanding the factors that affect oil prices and their succeeding results on gas oil is essential for individuals and organizations alike. This evaluation intends to take a look at the key chauffeurs behind oil rate changes, including supply and demand characteristics, geopolitical influences, and market conjecture. Furthermore, it will explore exactly how modifications in oil prices influence fuel oil prices, which, subsequently, have significant effects for different sectors such as manufacturing, transportation, and energy manufacturing. By delving right into this subject, we can acquire useful understandings into the complicated interaction between oil prices and gas oil, allowing far better decision-making and threat management strategies.Supply and Need Characteristics

Supply and need dynamics play a critical role in figuring out the cost of oil and its effect on the fuel oil market. The global oil market is influenced by numerous elements, consisting of geopolitical events, economic conditions, and technological innovations. Understanding the dynamics of supply and demand is essential for stakeholders in the gas oil sector to properly anticipate oil costs and make informed organization choices.

The supply of oil is identified by the manufacturing capabilities of oil-producing nations, consisting of OPEC participants, non-OPEC nations, and shale oil manufacturers (cod oil prices long island). Political instability in oil-producing regions, natural catastrophes, and conflicts can disrupt the supply of oil, leading to rate variations. On the various other hand, technical improvements and increased investments in exploration and manufacturing can boost supply and support rates

Need for oil is influenced by financial factors such as GDP development, commercial task, and transportation needs. Emerging economic situations with rapidly growing markets and raising urbanization add to the climbing need for oil. Nonetheless, aspects like energy change policies, advancements in renewable resource resources, and performance renovations can influence oil need adversely.

The interplay in between supply and demand establishes the stability cost of oil. When supply surpasses need, costs tend to decrease, and vice versa. Variations in oil rates have a cascading impact on the gas oil industry, impacting manufacturing prices, profitability, and consumer actions. Stakeholders in the fuel oil industry carefully check supply and demand dynamics to prepare for cost motions and adapt their techniques as necessary.

Geopolitical Influences

Geopolitical variables dramatically impact the worldwide oil market and ultimately influence the cost of oil and its results on the fuel oil industry. Any kind of disturbance in oil supply from the Middle East due to political instability or problems can cause a substantial increase in oil costs. Overall, understanding and evaluating geopolitical impacts is important for forecasting oil price motions and their effects on the fuel oil industry.Market Conjecture

Market speculation plays a substantial duty fit the dynamics of the oil price and its influence on the gas oil market. Conjecture refers to the activity of acquiring and selling oil contracts with the expectation of making benefit from rate changes. Traders, capitalists, and financial establishments take part in market conjecture to take advantage of short-term price movements. Their activities, affected by numerous aspects such as economic signs, geopolitical events, and supply and demand dynamics, can contribute to enhanced volatility in the oil market.Market conjecture can have both positive and adverse impacts on the fuel oil market. On one hand, it can give liquidity and effectiveness to the market by promoting price exploration and danger monitoring. Speculators bring additional funding and expertise, improving cod oil prices market deepness and permitting smoother deals. This can benefit gas oil producers and customers by giving an extra steady and transparent prices mechanism.

On the other hand, too much supposition can cause cost distortions and market control. Speculative tasks driven by herd attitude or illogical enthusiasm can cause prices to depart from their essential values. This can cause enhanced cost volatility, making it testing for gas oil industry individuals to prepare and make informed choices. Additionally, excessive speculation can develop synthetic rate bubbles, which, when they break, can have extreme repercussions for the gas oil market and the more comprehensive economic situation.

Impact on Gas Oil Rates

The impact of market supposition on fuel oil prices can be substantial. Market speculation describes the acquiring and selling of gas oil contracts based upon awaited price motions, rather than on the actual physical supply and need of the product. Speculators, such as hedge funds and investment financial institutions, play a crucial duty in determining gas oil rates as they take part in futures trading, which can affect the overall market view and prices.When speculators think that gas oil prices will boost, they often tend to buy agreements, increasing the demand and as a result the cost of gas oil. On the other hand, when speculators prepare for a reduction in prices, they offer contracts, bring about a decrease popular and subsequently reduced fuel oil costs.

The effect of market supposition on gas oil costs can be both favorable and adverse. On one hand, it can give liquidity and assistance maintain the market by permitting producers and consumers to hedge versus price changes. On the various other hand, excessive conjecture can bring about price volatility and distortions, which can have unfavorable results on fuel oil rates and the total economic climate.

It is very important for policymakers and market regulatory authorities to handle and check market supposition to make certain that it does not come to be excessive and destabilize fuel oil prices. By executing effective laws and oversight, authorities can minimize the prospective unfavorable effects of market conjecture and keep stability in fuel oil rates.

Impacts on Industries and Consumers

When oil rates rise, markets that depend greatly on gas oil for their operations, such as farming, production, and transport, experience boosted manufacturing expenses. Climbing fuel oil rates can result in enhanced transportation prices, leading to higher costs for products that need to be carried long ranges.In addition, higher gas oil prices can likewise impact customer actions. As the price of gas surges, consumers may have to allocate more of their budget plan towards transport costs, leaving less money for other purchases. This can result in a decline in optional costs and a slowdown in consumer-driven markets such as retail and friendliness.

On the various other hand, when gas oil rates decline, industries might gain from reduced production prices, causing potential savings that can be passed on to customers. cod oil prices. Reduced fuel rates can also boost customer spending, as individuals have much more disposable revenue to assign towards various other items and services

Verdict

In conclusion, the price of oil is influenced by various aspects such as supply and demand characteristics, geopolitical impacts, and market speculation. These factors have significant results on fuel oil rates, which subsequently impact numerous sectors and consumers. Comprehending these impacts is crucial for policymakers, businesses, and consumers to navigate the changes in oil costs and mitigate their effects on the economic climate.

Market conjecture plays a significant function in forming the dynamics of the oil rate and its influence on the fuel oil industry. When oil rates rise, markets that depend greatly on fuel oil for their procedures, such as manufacturing, transportation, and agriculture, experience increased production costs.

Report this wiki page